Automotive Adaptive Front Lighting Market: By Vehicle Type, By Technology, By Component, and Region Forecast 2020-2031

Severity: Warning

Message: fopen(/tmp/ci_sessiono9jr5ar6kvtae8ngrnnn72v98jr6o636): failed to open stream: No space left on device

Filename: drivers/Session_files_driver.php

Line Number: 177

Backtrace:

File: /var/www/precisionbusinessinsights.com/application/controllers/User.php

Line: 9

Function: __construct

File: /var/www/precisionbusinessinsights.com/index.php

Line: 315

Function: require_once

Severity: Warning

Message: session_start(): Failed to read session data: user (path: /tmp)

Filename: Session/Session.php

Line Number: 137

Backtrace:

File: /var/www/precisionbusinessinsights.com/application/controllers/User.php

Line: 9

Function: __construct

File: /var/www/precisionbusinessinsights.com/index.php

Line: 315

Function: require_once

Automotive Adaptive Front Lighting Market: By Vehicle Type, By Technology, By Component, and Region Forecast 2020-2031

Automotive Adaptive Front Lighting Market size was valued at US$ 9,723.2 million in 2023, and is expected to grow at a 13.7% CAGR from 2024 to 2030. Adaptive front lighting systems are the lighting systems used in the automotive which have the ability to adapt and adjust the lightings of the vehicle suitable for the outer surroundings. The lights are adjusted based on the climatic factors and road conditions like rain, fog, day or night, traffic, curve roads. This system delivers a higher visibility to the driver compared to other lighting systems. Most of the adapting lighting system comes with LED as it consumes less energy and provides higher illumination.

The rising incidents of fatal accidents, increasing sales in automotive industry and the government mandating the installation of the Adaptive lighting system in the passenger vehicle are the key factors in the adaptive front lighting market. In addition, the adoption of advanced driver assistance system in every automotive vehicle is expected to fuel the marketacross the globe over the forecasted years. The increased manufacturing & availability of counterfeit products available in the market and also the high cost of adaptive light system is expected to hinder the market growth. The adaptive lighting systems are primarily offered in the premium vehicles due to its high cost.

Furthermore, the adaptive lights are very complex to install and any mistake may lead to disrupt the whole lighting system of vehicle this may be expected to hold the market growth in the forecasted period. Countries like India, Indonesia, China, Japan has increasing population and is expected to the sales of automobile in region and increase in adopting of advanced technologies may boost the growth of adaptive front lighting system in the market. Geographically, Europe region held the major market share in 2022 and is expected to dominate the global marketin the forecasted years.

Study Period

2025-2031Base Year

2024CAGR

13.7%Largest Market

EuropeFastest Growing Market

North-America

Automotive adaptive front headlight system market is growing due to the increase in the sales of automotive vehicles especially in the passenger vehicles, increasing number of fatal accidents with increasing concern of safety among the public and the government mandating regulation policies to install adaptive light system in all automotives are the key factors to propel the adaptive front lighting market across the globe. Furthermore, the advancement of new technologies, and the growing market demand for advanced driving assistance system is expected to boost the growth of adaptive front lighting market across the globe in the forecasted period.

|

Report Benchmarks |

Details |

|

Report Study Period |

2025-2031 |

|

Market Size in 2023 |

US$ 9,723.2 million |

|

Market CAGR |

13.7% |

|

By Vehicle Type |

|

|

By Component |

|

|

By Region |

|

Download Free Sample Report

The automotive adaptive front lighting market size was valued at US$ 9,723.2 million in 2023 and is set to grow at a significant CAGR of 13.7% from 2024-2030.

The leading players in the global market are Valeo, Magneti Marelli S.p, Osram, Hella, Hyundai Mobis, Continental AG, Denso Corporation, Neolite ZKW, Stanley Electric CO., LTD, Robert Bosch GmbH, Fraunhofer-Gesellschaft, Johnson Electric, General Electric Company, Denso Corporation, Ichikoh Industries, Koito Manufacturing Co., Ltd, Philips, Robert Bosch GmbH, Stanley Electric Co. Ltd

Historic years considered for the market study are 2018 through 2022, 2022 is considered as the base year for market estimation and Seven years forecast presented from 2023– 2029.

Content Updated Date: Feb 2025

| 1. Executive Summary |

| 2. Global Automotive Adaptive Front Lighting Market Introduction |

| 2.1.Global Automotive Adaptive Front Lighting Market - Taxonomy |

| 2.2.Global Automotive Adaptive Front Lighting Market - Definitions |

| 2.2.1.Vehicle Type |

| 2.2.2.Component |

| 2.2.3.Region |

| 3. Global Automotive Adaptive Front Lighting Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID 19 on Market |

| 4. Global Automotive Adaptive Front Lighting Market Analysis, 2020 - 2024 and Forecast 2025 - 2031 |

| 4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Automotive Adaptive Front Lighting Market By Vehicle Type, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 5.1. Mid-segment Passenger Car |

| 5.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Light Commercial Vehicle |

| 5.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Heavy Commercial Vehicle |

| 5.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Sports Car |

| 5.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 5.5. Premium Vehicle |

| 5.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.5.3. Market Opportunity Analysis |

| 6. Global Automotive Adaptive Front Lighting Market By Component, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 6.1. Controller |

| 6.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Sensor |

| 6.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Camera |

| 6.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 6.4. Lamp Assembly |

| 6.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.4.3. Market Opportunity Analysis |

| 6.5. Others |

| 6.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.5.3. Market Opportunity Analysis |

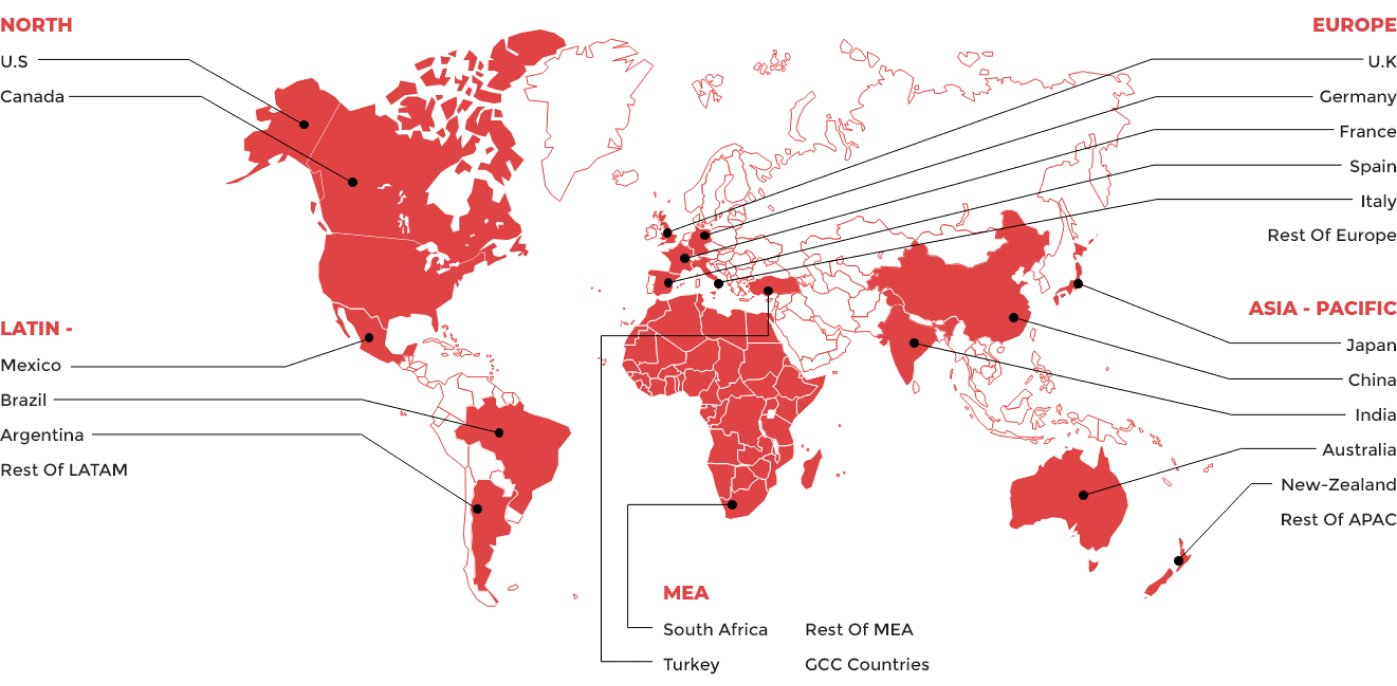

| 7. Global Automotive Adaptive Front Lighting Market By Region, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 7.1. North America |

| 7.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Europe |

| 7.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Asia Pacific (APAC) |

| 7.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 7.4. Middle East and Africa (MEA) |

| 7.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.4.3. Market Opportunity Analysis |

| 7.5. Latin America |

| 7.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.5.3. Market Opportunity Analysis |

| 8. North America Automotive Adaptive Front Lighting Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 8.1. Vehicle Type Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.1.1.Mid-segment Passenger Car |

| 8.1.2.Light Commercial Vehicle |

| 8.1.3.Heavy Commercial Vehicle |

| 8.1.4.Sports Car |

| 8.1.5.Premium Vehicle |

| 8.2. Component Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.2.1.Controller |

| 8.2.2.Sensor |

| 8.2.3.Camera |

| 8.2.4.Lamp Assembly |

| 8.2.5.Others |

| 8.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.3.1.United States of America (USA) |

| 8.3.2.Canada |

| 9. Europe Automotive Adaptive Front Lighting Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 9.1. Vehicle Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.1.1.Mid-segment Passenger Car |

| 9.1.2.Light Commercial Vehicle |

| 9.1.3.Heavy Commercial Vehicle |

| 9.1.4.Sports Car |

| 9.1.5.Premium Vehicle |

| 9.2. Component Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.2.1.Controller |

| 9.2.2.Sensor |

| 9.2.3.Camera |

| 9.2.4.Lamp Assembly |

| 9.2.5.Others |

| 9.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.3.1.Germany |

| 9.3.2.France |

| 9.3.3.Italy |

| 9.3.4.United Kingdom (UK) |

| 9.3.5.Spain |

| 9.3.6.Rest of EU |

| 10. Asia Pacific (APAC) Automotive Adaptive Front Lighting Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 10.1. Vehicle Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Mid-segment Passenger Car |

| 10.1.2.Light Commercial Vehicle |

| 10.1.3.Heavy Commercial Vehicle |

| 10.1.4.Sports Car |

| 10.1.5.Premium Vehicle |

| 10.2. Component Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Controller |

| 10.2.2.Sensor |

| 10.2.3.Camera |

| 10.2.4.Lamp Assembly |

| 10.2.5.Others |

| 10.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.China |

| 10.3.2.India |

| 10.3.3.Australia and New Zealand (ANZ) |

| 10.3.4.Japan |

| 10.3.5.Rest of APAC |

| 11. Middle East and Africa (MEA) Automotive Adaptive Front Lighting Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 11.1. Vehicle Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Mid-segment Passenger Car |

| 11.1.2.Light Commercial Vehicle |

| 11.1.3.Heavy Commercial Vehicle |

| 11.1.4.Sports Car |

| 11.1.5.Premium Vehicle |

| 11.2. Component Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Controller |

| 11.2.2.Sensor |

| 11.2.3.Camera |

| 11.2.4.Lamp Assembly |

| 11.2.5.Others |

| 11.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.GCC Countries |

| 11.3.2.South Africa |

| 11.3.3.Rest of MEA |

| 12. Latin America Automotive Adaptive Front Lighting Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 12.1. Vehicle Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Mid-segment Passenger Car |

| 12.1.2.Light Commercial Vehicle |

| 12.1.3.Heavy Commercial Vehicle |

| 12.1.4.Sports Car |

| 12.1.5.Premium Vehicle |

| 12.2. Component Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Controller |

| 12.2.2.Sensor |

| 12.2.3.Camera |

| 12.2.4.Lamp Assembly |

| 12.2.5.Others |

| 12.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Brazil |

| 12.3.2.Mexico |

| 12.3.3.Rest of LA |

| 13. Competition Landscape |

| 13.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 13.2.1.Valeo |

| 13.2.2.Magneti Marelli S.p.A |

| 13.2.3.Osram |

| 13.2.4.Hella |

| 13.2.5.Hyundai Mobis |

| 13.2.6.Continental AG |

| 13.2.7.Denso Corporation |

| 13.2.8.Neolite ZKW |

| 14. Research Methodology |

| 15. Appendix and Abbreviations |

Key Market Players