Commercial Refrigeration Market: By Product Type, By Application and Region, Forecast 2020-2031

Commercial Refrigeration Market: By Product Type, By Application and Region, Forecast 2020-2031

Commercial Refrigeration Market size was valued at US$ 8,931.7 million in 2024 and is expected to reach US$ 12,651.8 million by 2031, growing at a significant CAGR of 5.1% from 2025-2031. Commercial refrigeration is the use of equipment and systems to keep perishable items cool or frozen at a suitable temperature. It is used in businesses that deal with food products, such as restaurants, grocery stores, convenience stores, and hotels. The market is the industry that involves the use of cold storage equipment in commercial settings to keep perishable items frozen or cool. The growth drivers of the market are growing demand for frozen and processed food across the world, rising demand for vaccine storage units.

However, the constraints of the market are stringent regulations against the use of fluorocarbon refrigerants and energy consumption is a significant concern, as traditional systems are often power-intensive, leading to higher operational costs and environmental impact. The emerging opportunities of the market are increased consumer desire for high-quality and hygienic food storage solutions, and advancements in energy-efficient refrigeration technologies. The key trends of the market are adoption of use of smart sensors and Internet of Things (IoT) technology to monitor and manage refrigeration systems in real time, use of natural refrigerants like carbon dioxide, ammonia, and hydrocarbons, which have a lower environmental impact than traditional synthetic refrigerants are the key growth trends.

The leading companies highlighted in the market report include such as AHT Cooling Systems GmbH, Daikin Industries Ltd., Dover Corporation, Electrolux AB, Hussmann Corporation, Illinois Tool Works Inc., Johnson Control, Lennox International Inc., Panasonic Corporation, Whirlpool Corporation and others. Also, a comprehensive analysis of industry verticals and market participants that provides a clear overview of the competitive landscape in relation to the sectors served by the company’s products and services, market share, service offerings, financial reports, significant developments, market strategy, competitive position, and geographic reach.

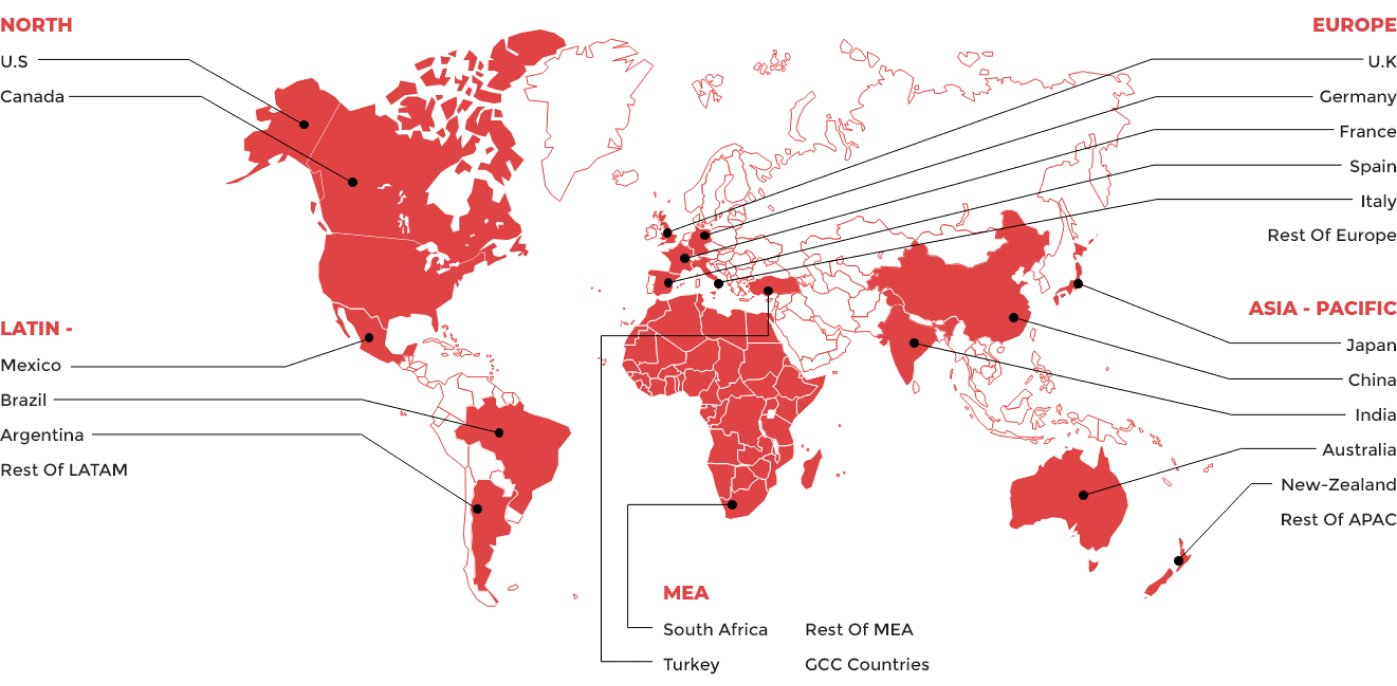

• Asia Pacific market dominated the market in 2023.

• The North America market is expected to expand significantly from 2024 to 2030.

• Based on product type, the chest refrigeration segment is having highest market share in 2023.

• By application, the restaurants and hotels segment has captured highest market share in 2023.

• In July 2021, BITZER announced the launch of gas coolers for carbon dioxide (CO2) applications in commercial and light industrial refrigeration. These coolers are resistant to pressure and thermally efficient and has an advantage for systems with medium to large capacities of more than 250 kW.

• In November 2021, Whirlpool Corporation announced investing US$ 65 million over the next few years in Ottawa, Ohio, to position the plant as the Superior Refrigeration Factory in North America.

In January 2022, Carrier Commercial Refrigeration PowerCO2OL refrigeration system was installed at a COVID-19 vaccine storage facility in Spain. The system feature was it uses carbon dioxide, a natural refrigerant, as a sustainable and low-GWP refrigerant to help preserve important vaccines in Spain.

By Product Type: Among all product types, the chest refrigeration is having the highest market share in 2023. A chest refrigerator is a large, horizontal appliance that stores food at a very cold temperature to freeze it. They are most widely used as chest refrigerators are designed to keep cold air trapped inside, even when the lid is opened. This reduces the workload on the compressor, which leads to lower energy consumption.

By Application: The restaurants and hotels sector dominates the market in application segment as restaurants and hotels depend highly on commercial refrigeration to store perishable food items such as meat, dairy, fruits, vegetables, and beverages. Maintaining food quality and safety is critical in the hospitality industry, where food freshness directly impacts customer satisfaction, so to keep them fresh the refrigeration system is used.

Study Period

2025-2031Base Year

2024CAGR

5.1%Largest Market

Asia-PacificFastest Growing Market

North-America

The rising demand for vaccine storage units is a key driver of the commercial refrigeration market due to factors like the general growing emphasis on cold supply chains to maintain vaccine efficacy, regulatory compliance as governments and health organizations have stringent regulations for vaccine storage which increases demand for specialized refrigeration units that meet these standards, such as temperature-controlled freezers and refrigerators.

Stringent regulations against the use of fluorocarbon refrigerants act as a restraint of the market by imposing limits on the types of refrigerants that can be used in systems. These regulations are primarily due to the environmental concerns associated with fluorocarbon refrigerants, as they can negatively impact the ozone layer and contribute to climate change. As a result, manufacturers may face increased costs for compliance, leading to higher purchasing and maintenance costs for refrigeration equipment, and may need to invest in alternative refrigerant technologies. These factors can hinder market growth and innovation in the commercial refrigeration sector.

The increased consumer desire for high-quality and hygienic food storage solutions presents a significant opportunity for the market. As consumers become more health-conscious and demand fresh, ready-to-eat, and convenient food options, industries such as retail and food services are increasingly investing in advanced refrigeration systems. These systems not only maintain the quality and safety of perishable goods like bakery, dairy, and meat products but also enhance the freshness and hygiene of food, catering to consumer preferences and potentially driving sales growth in the market.

Natural refrigerants like carbon dioxide, ammonia, and hydrocarbons are a key growth trend in the market as they are more environmentally friendly than traditional synthetic refrigerants. Basically, natural refrigerants have low or zero global warming potential (GWP), which presents that they don't contribute to greenhouse gas emissions which is much more beneficial to the Earth than synthetic refrigerants as they do not increase climate change or reduce ozone.

|

Report Benchmarks |

Details |

|

Report Study Period |

2025-2031 |

|

Market Size in 2024 |

US$ 8,931.7 million |

|

Market Size in 2031 |

US$ 12,651.8 million |

|

Market CAGR |

5.1% |

|

By Product Type |

|

|

By Application |

|

|

By Region |

|

The history of refrigeration began in the 1700s with the development of a cooling box by Scottish chemist William Cullen. Other notable inventors, such as Benjamin Franklin and John Hadley, also tested ways to cool objects using volatile liquids. Commercial refrigeration systems are used to store and display perishable items at low temperatures to maintain their quality, safety, and shelf life. They are used in a variety of settings, including restaurants, supermarkets, convenience stores, and hospitals. Commercial refrigeration has different temperature band ranging from -30 °C to + 5 °C and a capacity range from 5 kW to 500 kW in point-of-sale facilities. The development of commercial refrigeration has been driven by advancements in technology, which have led to more energy-efficient, environmentally friendly, and user-friendly systems. Some future developments include improved energy efficiency, reduced waste, eco-friendly refrigerants, and better temperature control.

Download Free Sample Report

The commercial refrigeration market size was valued at US$ 8,931.7 million in 2024 and is expected to reach US$ 12,651.8 million by 2031, growing at a significant CAGR of 5.1% from 2025-2031

• Increased consumer desire for high-quality and hygienic food storage solutions

• Advancements in energy-efficient refrigeration technologies.

The key players in the market are Johnson Control, Lennox International Inc., Panasonic Corporation, and Whirlpool Corporation.

Chest refrigeration is most widely used in the market.

Asia Pacific region is dominating the market.

| 1. Executive Summary |

| 2. Global Commercial Refrigeration Market Introduction |

| 2.1.Global Commercial Refrigeration Market - Taxonomy |

| 2.2.Global Commercial Refrigeration Market - Definitions |

| 2.2.1.Product Type |

| 2.2.2.Application |

| 2.2.3.Region |

| 3. Global Commercial Refrigeration Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID 19 on Market |

| 4. Global Commercial Refrigeration Market Analysis, 2020 - 2024 and Forecast 2025 - 2031 |

| 4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Commercial Refrigeration Market By Product Type, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 5.1. Deep Freezers |

| 5.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Bottle Coolers |

| 5.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Storage Water Coolers |

| 5.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Commercial Kitchen Refrigeration |

| 5.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 5.5. Medical Refrigeration |

| 5.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.5.3. Market Opportunity Analysis |

| 5.6. Chest Refrigeration |

| 5.6.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.6.3. Market Opportunity Analysis |

| 5.7. Other |

| 5.7.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.7.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.7.3. Market Opportunity Analysis |

| 6. Global Commercial Refrigeration Market By Application, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 6.1. Hospital |

| 6.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Retail Pharmacies |

| 6.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Supermarket and Hypermarket |

| 6.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 6.4. Convenience Stores |

| 6.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.4.3. Market Opportunity Analysis |

| 6.5. Restaurants and Hotels |

| 6.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.5.3. Market Opportunity Analysis |

| 6.6. Others |

| 6.6.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.6.3. Market Opportunity Analysis |

| 7. Global Commercial Refrigeration Market By Region, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 7.1. North America |

| 7.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Europe |

| 7.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Asia Pacific (APAC) |

| 7.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 7.4. Middle East and Africa (MEA) |

| 7.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.4.3. Market Opportunity Analysis |

| 7.5. Latin America |

| 7.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.5.3. Market Opportunity Analysis |

| 8. North America Commercial Refrigeration Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 8.1. Product Type Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.1.1.Deep Freezers |

| 8.1.2.Bottle Coolers |

| 8.1.3.Storage Water Coolers |

| 8.1.4.Commercial Kitchen Refrigeration |

| 8.1.5.Medical Refrigeration |

| 8.1.6.Chest Refrigeration |

| 8.1.7.Other |

| 8.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.2.1.Hospital |

| 8.2.2.Retail Pharmacies |

| 8.2.3.Supermarket and Hypermarket |

| 8.2.4.Convenience Stores |

| 8.2.5.Restaurants and Hotels |

| 8.2.6.Others |

| 8.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.3.1.United States of America (USA) |

| 8.3.2.Canada |

| 9. Europe Commercial Refrigeration Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 9.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.1.1.Deep Freezers |

| 9.1.2.Bottle Coolers |

| 9.1.3.Storage Water Coolers |

| 9.1.4.Commercial Kitchen Refrigeration |

| 9.1.5.Medical Refrigeration |

| 9.1.6.Chest Refrigeration |

| 9.1.7.Other |

| 9.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.2.1.Hospital |

| 9.2.2.Retail Pharmacies |

| 9.2.3.Supermarket and Hypermarket |

| 9.2.4.Convenience Stores |

| 9.2.5.Restaurants and Hotels |

| 9.2.6.Others |

| 9.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.3.1.Germany |

| 9.3.2.France |

| 9.3.3.Italy |

| 9.3.4.United Kingdom (UK) |

| 9.3.5.Spain |

| 9.3.6.Rest of EU |

| 10. Asia Pacific (APAC) Commercial Refrigeration Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 10.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Deep Freezers |

| 10.1.2.Bottle Coolers |

| 10.1.3.Storage Water Coolers |

| 10.1.4.Commercial Kitchen Refrigeration |

| 10.1.5.Medical Refrigeration |

| 10.1.6.Chest Refrigeration |

| 10.1.7.Other |

| 10.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Hospital |

| 10.2.2.Retail Pharmacies |

| 10.2.3.Supermarket and Hypermarket |

| 10.2.4.Convenience Stores |

| 10.2.5.Restaurants and Hotels |

| 10.2.6.Others |

| 10.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.China |

| 10.3.2.India |

| 10.3.3.Australia and New Zealand (ANZ) |

| 10.3.4.Japan |

| 10.3.5.Rest of APAC |

| 11. Middle East and Africa (MEA) Commercial Refrigeration Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 11.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Deep Freezers |

| 11.1.2.Bottle Coolers |

| 11.1.3.Storage Water Coolers |

| 11.1.4.Commercial Kitchen Refrigeration |

| 11.1.5.Medical Refrigeration |

| 11.1.6.Chest Refrigeration |

| 11.1.7.Other |

| 11.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Hospital |

| 11.2.2.Retail Pharmacies |

| 11.2.3.Supermarket and Hypermarket |

| 11.2.4.Convenience Stores |

| 11.2.5.Restaurants and Hotels |

| 11.2.6.Others |

| 11.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.GCC Countries |

| 11.3.2.South Africa |

| 11.3.3.Rest of MEA |

| 12. Latin America Commercial Refrigeration Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 12.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Deep Freezers |

| 12.1.2.Bottle Coolers |

| 12.1.3.Storage Water Coolers |

| 12.1.4.Commercial Kitchen Refrigeration |

| 12.1.5.Medical Refrigeration |

| 12.1.6.Chest Refrigeration |

| 12.1.7.Other |

| 12.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Hospital |

| 12.2.2.Retail Pharmacies |

| 12.2.3.Supermarket and Hypermarket |

| 12.2.4.Convenience Stores |

| 12.2.5.Restaurants and Hotels |

| 12.2.6.Others |

| 12.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Brazil |

| 12.3.2.Mexico |

| 12.3.3.Rest of LA |

| 13. Competition Landscape |

| 13.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 13.2.1.AHT Cooling Systems GmbH |

| 13.2.2.Daikin Industries Ltd. |

| 13.2.3.Dover Corporation |

| 13.2.4.Electrolux AB |

| 13.2.5.Hussmann Corporation |

| 13.2.6.Illinois Tool Works Inc. |

| 13.2.7.Johnson Control |

| 13.2.8.Lennox International Inc. |

| 13.2.9.Panasonic Corporation |

| 13.2.10.Whirlpool Corporation |

| 14. Research Methodology |

| 15. Appendix and Abbreviations |