Author

Muni Kumar Meravath is a seasoned Healthcare Market Research Analyst with over 6 years of experience in the healthc.....

Severity: Warning

Message: fopen(/tmp/ci_session2k7qjpv02mjanrpg2s1vn153mo2so6ua): failed to open stream: No space left on device

Filename: drivers/Session_files_driver.php

Line Number: 177

Backtrace:

File: /var/www/precisionbusinessinsights.com/application/controllers/User.php

Line: 9

Function: __construct

File: /var/www/precisionbusinessinsights.com/index.php

Line: 315

Function: require_once

Severity: Warning

Message: session_start(): Failed to read session data: user (path: /tmp)

Filename: Session/Session.php

Line Number: 137

Backtrace:

File: /var/www/precisionbusinessinsights.com/application/controllers/User.php

Line: 9

Function: __construct

File: /var/www/precisionbusinessinsights.com/index.php

Line: 315

Function: require_once

Microbiology Testing Market: By Product Type, By Application, By End-User and Region Forecast 2020-2031

Microbiology Testing Market size was valued at US$ 4,328.4 million in 2024 and is expected to reach US$ 8,762.3 million by 2031, growing at a significant CAGR of 10.6% from 2025-2031. Microbiology testing is an analytical technique utilized to determine the number of microorganisms in psoriasis biologicals samples, food, beverages, and environmental samples. The microbiology testing technique employs chemical, biological, biochemical, or molecular methods to identify and quantify microbes. The Chemicals & Reagents segment is anticipated to grow at a significant CAGR over the forecast years owing to the wide range of chemical reagent uses and research activities Constant advancements and development in technologies such as bio-therapeutics, cell culture, and recombinant DNA technology, which have allowed the manufacturers of a wide range of vital therapeutic agents, also fuel the demand for laboratory chemical reagents.

Furthermore, rising demand from the biotechnology industry may drive market expansion in the next years. The market for protein synthesis and DNA sequencing reagents has grown considerably in recent years. Technological improvements in microbiology testing, increased occurrences of infectious illnesses and epidemic outbreaks such as COVID-19, rising healthcare spending, and expanding private-public financing for infectious disease research are driving the growth of the market.

In February2020, QIAGEN partnered with Nigeria’s National Tuberculosis & Leprosy Control Program (NTBLCP) to adopt the World Health Organization (WHO) guidelines and guide healthcare professionals in dealing with latent TB

In July 2020, bioMérieux launched BIOFIRE MYCOPLASMA, an innovative test for mycoplasma detection in pharmaceutical products used for biotherapeutics (antibodies, hormones, cell and gene therapies, etc.), the most vibrant sector in the pharmaceutical industry. The new BIOFIRE MYCOPLASMA test, which is available in the United States, will be launched in some countries in Europe and the Asia-Pacific region in the coming months.

Study Period

2025-2031Base Year

2024CAGR

10.6%Largest Market

North-AmericaFastest Growing Market

Asia-Pacific

According to the WHO, three infectious diseases, including lower respiratory infections, diarrheal diseases, and TB, were among the top 10 causes of mortality globally in 2016. As a result, the increased frequency and incidence of infectious diseases drives the need for microbiological testing, resulting in worldwide market growth.

Furthermore, the rising number of COVID-19 cases contributes to the market's expansion. Growing government and private funds and support for research and development further drive the growth of the market. For instance, the Department of Science and Technology (DST), India, announced funding of approximately USD 26.42 million to many scientific institutions, startups, and industries to build innovative solutions to fight the COVID-19 pandemic on 8 April 2020.

|

Report Benchmarks |

Details |

|

Report Study Period |

2025-2031 |

|

Market Size in 2024 |

US$ 4,328.4 million |

|

Market Size in 2031 |

US$ 8,762.3 million |

|

Market CAGR |

10.6% |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

Download Free Sample Report

The microbiology testing market size was valued at US$ 4,328.4 million in 2024 and is projected to grow at a CAGR of 10.6% from 2025-2031.

The market key players are: bio Mérieux SA (France) Danaher. (US) BD (US) Abbott (US) F. Hoffmann-La Roche Ltd (Switzerland) Bruker (US) Hologic, Inc. (US) Bio-Rad Laboratories, Inc. (US) QIAGEN (Germany) Thermo Fisher Scientific, Inc. (US) Agilent Technologies, Inc. (US) Merck KGaA (Germany) 3M (US)

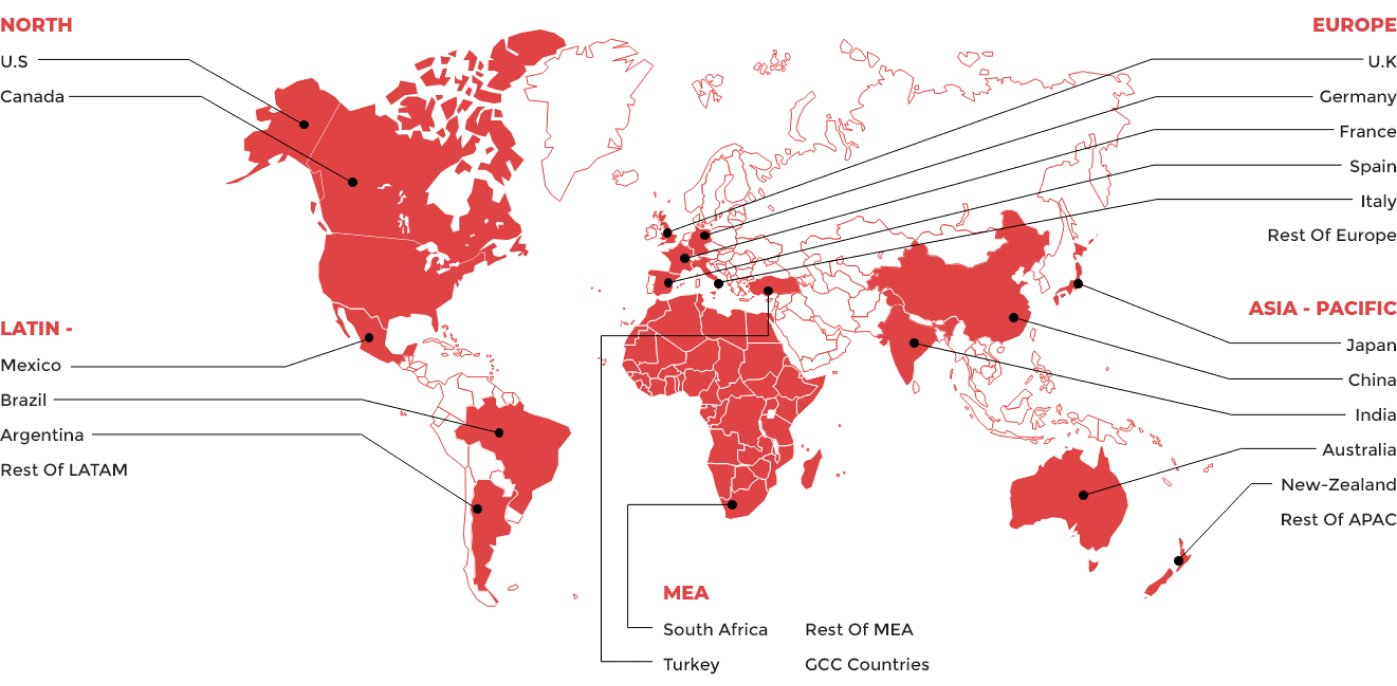

The market has been classified into North America, Asia Pacific, Europe, Latin America, Middle East and Africa, and the rest of MEA.

Content Updated Date: Jun 2025

| 1. Executive Summary |

| 2. Global Microbiology Testing Market Introduction |

| 2.1.Global Microbiology Testing Market - Taxonomy |

| 2.2.Global Microbiology Testing Market - Definitions |

| 2.2.1.Product Type |

| 2.2.2.Application |

| 2.2.3.End Users |

| 2.2.4.Geography |

| 2.2.5.Region |

| 3. Global Microbiology Testing Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID 19 on Market |

| 4. Global Microbiology Testing Market Analysis, 2020 - 2024 and Forecast 2025 - 2031 |

| 4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Microbiology Testing Market By Product Type , 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 5.1. Instruments |

| 5.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Chemicals & Reagents |

| 5.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Consumables & Accessories |

| 5.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Others |

| 5.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 6. Global Microbiology Testing Market By Application, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 6.1. Gastrointestinal Infections |

| 6.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Respiratory Infections |

| 6.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Urinary Tract Infections |

| 6.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 6.4. Bloodstream Infections |

| 6.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.4.3. Market Opportunity Analysis |

| 6.5. Sexually Transmitted Infections |

| 6.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.5.3. Market Opportunity Analysis |

| 6.6. Others |

| 6.6.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.6.3. Market Opportunity Analysis |

| 7. Global Microbiology Testing Market By End Users, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 7.1. Hospital Based Laboratories |

| 7.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Independent Laboratories |

| 7.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Academics & Research Institutes |

| 7.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 7.4. Others |

| 7.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.4.3. Market Opportunity Analysis |

| 8. Global Microbiology Testing Market By Geography, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 8.1. North America |

| 8.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.1.3. Market Opportunity Analysis |

| 8.2. Europe |

| 8.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.2.3. Market Opportunity Analysis |

| 8.3. The Asia Pacific |

| 8.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.3.3. Market Opportunity Analysis |

| 8.4. Latin America |

| 8.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.4.3. Market Opportunity Analysis |

| 8.5. MEA |

| 8.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.5.3. Market Opportunity Analysis |

| 9. Global Microbiology Testing Market By Region, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 9.1. North America |

| 9.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.1.3. Market Opportunity Analysis |

| 9.2. Europe |

| 9.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.2.3. Market Opportunity Analysis |

| 9.3. Asia Pacific (APAC) |

| 9.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.3.3. Market Opportunity Analysis |

| 9.4. Middle East and Africa (MEA) |

| 9.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.4.3. Market Opportunity Analysis |

| 9.5. Latin America |

| 9.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.5.3. Market Opportunity Analysis |

| 10. North America Microbiology Testing Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 10.1. Product Type Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Instruments |

| 10.1.2.Chemicals & Reagents |

| 10.1.3.Consumables & Accessories |

| 10.1.4.Others |

| 10.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Gastrointestinal Infections |

| 10.2.2.Respiratory Infections |

| 10.2.3.Urinary Tract Infections |

| 10.2.4.Bloodstream Infections |

| 10.2.5.Sexually Transmitted Infections |

| 10.2.6.Others |

| 10.3. End Users Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.Hospital Based Laboratories |

| 10.3.2.Independent Laboratories |

| 10.3.3.Academics & Research Institutes |

| 10.3.4.Others |

| 10.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.4.1.North America |

| 10.4.2.Europe |

| 10.4.3.The Asia Pacific |

| 10.4.4.Latin America |

| 10.4.5.MEA |

| 10.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.5.1.United States of America (USA) |

| 10.5.2.Canada |

| 11. Europe Microbiology Testing Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 11.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Instruments |

| 11.1.2.Chemicals & Reagents |

| 11.1.3.Consumables & Accessories |

| 11.1.4.Others |

| 11.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Gastrointestinal Infections |

| 11.2.2.Respiratory Infections |

| 11.2.3.Urinary Tract Infections |

| 11.2.4.Bloodstream Infections |

| 11.2.5.Sexually Transmitted Infections |

| 11.2.6.Others |

| 11.3. End Users Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.Hospital Based Laboratories |

| 11.3.2.Independent Laboratories |

| 11.3.3.Academics & Research Institutes |

| 11.3.4.Others |

| 11.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.4.1.North America |

| 11.4.2.Europe |

| 11.4.3.The Asia Pacific |

| 11.4.4.Latin America |

| 11.4.5.MEA |

| 11.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.5.1.Germany |

| 11.5.2.France |

| 11.5.3.Italy |

| 11.5.4.United Kingdom (UK) |

| 11.5.5.Spain |

| 11.5.6.Rest of EU |

| 12. Asia Pacific (APAC) Microbiology Testing Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 12.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Instruments |

| 12.1.2.Chemicals & Reagents |

| 12.1.3.Consumables & Accessories |

| 12.1.4.Others |

| 12.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Gastrointestinal Infections |

| 12.2.2.Respiratory Infections |

| 12.2.3.Urinary Tract Infections |

| 12.2.4.Bloodstream Infections |

| 12.2.5.Sexually Transmitted Infections |

| 12.2.6.Others |

| 12.3. End Users Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Hospital Based Laboratories |

| 12.3.2.Independent Laboratories |

| 12.3.3.Academics & Research Institutes |

| 12.3.4.Others |

| 12.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.4.1.North America |

| 12.4.2.Europe |

| 12.4.3.The Asia Pacific |

| 12.4.4.Latin America |

| 12.4.5.MEA |

| 12.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.5.1.China |

| 12.5.2.India |

| 12.5.3.Australia and New Zealand (ANZ) |

| 12.5.4.Japan |

| 12.5.5.Rest of APAC |

| 13. Middle East and Africa (MEA) Microbiology Testing Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 13.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.1.1.Instruments |

| 13.1.2.Chemicals & Reagents |

| 13.1.3.Consumables & Accessories |

| 13.1.4.Others |

| 13.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.2.1.Gastrointestinal Infections |

| 13.2.2.Respiratory Infections |

| 13.2.3.Urinary Tract Infections |

| 13.2.4.Bloodstream Infections |

| 13.2.5.Sexually Transmitted Infections |

| 13.2.6.Others |

| 13.3. End Users Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.3.1.Hospital Based Laboratories |

| 13.3.2.Independent Laboratories |

| 13.3.3.Academics & Research Institutes |

| 13.3.4.Others |

| 13.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.4.1.North America |

| 13.4.2.Europe |

| 13.4.3.The Asia Pacific |

| 13.4.4.Latin America |

| 13.4.5.MEA |

| 13.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.5.1.GCC Countries |

| 13.5.2.South Africa |

| 13.5.3.Rest of MEA |

| 14. Latin America Microbiology Testing Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 14.1. Product Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.1.1.Instruments |

| 14.1.2.Chemicals & Reagents |

| 14.1.3.Consumables & Accessories |

| 14.1.4.Others |

| 14.2. Application Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.2.1.Gastrointestinal Infections |

| 14.2.2.Respiratory Infections |

| 14.2.3.Urinary Tract Infections |

| 14.2.4.Bloodstream Infections |

| 14.2.5.Sexually Transmitted Infections |

| 14.2.6.Others |

| 14.3. End Users Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.3.1.Hospital Based Laboratories |

| 14.3.2.Independent Laboratories |

| 14.3.3.Academics & Research Institutes |

| 14.3.4.Others |

| 14.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.4.1.North America |

| 14.4.2.Europe |

| 14.4.3.The Asia Pacific |

| 14.4.4.Latin America |

| 14.4.5.MEA |

| 14.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.5.1.Brazil |

| 14.5.2.Mexico |

| 14.5.3.Rest of LA |

| 15. Competition Landscape |

| 15.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 15.2.1.bioMérieux SA (France) |

| 15.2.2.Danaher. (US) |

| 15.2.3.BD (US) |

| 15.2.4.Abbott (US) |

| 15.2.5.F. Hoffmann-La Roche Ltd (Switzerland) |

| 15.2.6.Bruker (US) |

| 15.2.7.Hologic, Inc. (US) |

| 15.2.8.Bio-Rad Laboratories, Inc. (US) |

| 15.2.9.QIAGEN (Germany) |

| 15.2.10.Thermo Fisher Scientific, Inc. (US) |

| 15.2.11.Agilent Technologies, Inc. (US) |

| 15.2.12.Merck KGaA (Germany) |

| 15.2.13.3M (US) |

| 16. Research Methodology |

| 17. Appendix and Abbreviations |

Key Market Players