Author

Prem Kumar with profound experience and sound knowledge across a wide range of market forecasting methods, demand f.....

Performance Coatings Market: By Type, By Coating Technology, End-user Industry, and Region Forecast 2020-2031

Performance Coatings Market size was valued at US$ 40.3 billion in 2024 and is expected to reach US$ 56.0 billion by 2031, growing at a significant CAGR of 4.8% from 2025-2031. Performance coatings are frequently utilised in environments where surfaces and structures need to be durable, chemical resistant, and improved abrasion. They are made to meet the specifications of their main purpose, which is to safeguard the surface on which they are coated. In a number of end-use industries, including construction, automotive and transportation, industrial, aerospace & defence, marine, and others, performance coatings can be applied using a variety of techniques, including solvent-based coating, water-based coating, and powder-based coatings. The increase in demand for performance coatings in the automotive and marine industries is the main factor propelling the growth of the worldwide performance coatings market. Due to their superior performance characteristics, such as adhesion, alkali resistance, flexibility, chemical resistance, heat resistance, ultraviolet (UV) resistance, moisture tolerance, and resistance to permeating, performance coatings are in high demand in the automotive, transportation, and marine industries. Over the course of the forecast period, these characteristics are anticipated to drive the global performance coating market. Further predicted to drive product demand in industrial textile production is the expanding use of performance coatings in the industrial sector. Rollers used in the manufacture of textiles are covered with performance coatings to help them endure high temperatures, corrosive chemicals, and abrasive conditions. During the review period, it is anticipated that increased automotive production and sales due to better economic development will drive up demand for performance coatings. Automobile coatings have been regarded as one of the most significant markets in recent years and are essential to the automobile sector. In automotive applications, polyurethane coating is frequently used as a high-performance topcoat binder. Epoxy coating, in contrast, is utilised as a primer or as the layer under the topcoat layer due to its excellent adherence and corrosion resistance. The aerospace and defence industry's extensive usage of industrial coatings in windscreen glass, gas turbine engines, air containers, rocket exhaust cones, insulating tiles, space shuttles and engine components is a major market driver.

Study Period

2025-2031Base Year

2024CAGR

4.8%Largest Market

Asia-PacificFastest Growing Market

North-America

The market is expanding due to an increasing trend of temperature-resistant paint adoption. Moreover, there has been a shift towards environmentally friendly and more sustainable practices adopted by consumers globally. This development will provide further scope for expansion in various industries such as automotive, aerospace & defense, construction activity, etc., which are expected to drive demand for high-performance coating products worldwide. Furthermore, rising globalization trends have increased manufacturing activities across various regions due to rapid transportation and trade facilities that allow businesses to operate at a low cost with little time lag. In addition, technological advancements around better process optimization methods have led suppliers towards using advanced materials while reducing product weight without compromising durability or quality levels required during application on surfaces.

|

Report Benchmarks |

Details |

|

Report Study Period |

2025-2031 |

|

Market Size in 2024 |

US$ 40.3 billion |

|

Market Size in 2031 |

US$ 56.0 billion |

|

Market CAGR |

4.8% |

|

By Type |

|

|

By Coating Technology |

|

|

By End User |

|

|

By Region |

|

Download Free Sample Report

Performance coatings market size was valued at US$ 40.3 billion in 2024 and is expected to reach US$ 56.0 billion by 2031, growing at a significant CAGR of 4.8%.

The market key players are: Akzo Nobel NV (Netherlands) PPG Industries Inc. (US) Kansai Nerolac Paints Limited (India) Metal Coatings Corp. (US) Toefco Engineered Coating Systems Inc. (US) Endura Coatings LLC (US) Beckers Group (Germany) Nippon Paint Holdings Co. Ltd (Japan) The Sherwin-Williams Company (US) AFT Fluorotec Ltd (UK) The Chemours Company (US) Hempel Group (Denmark)

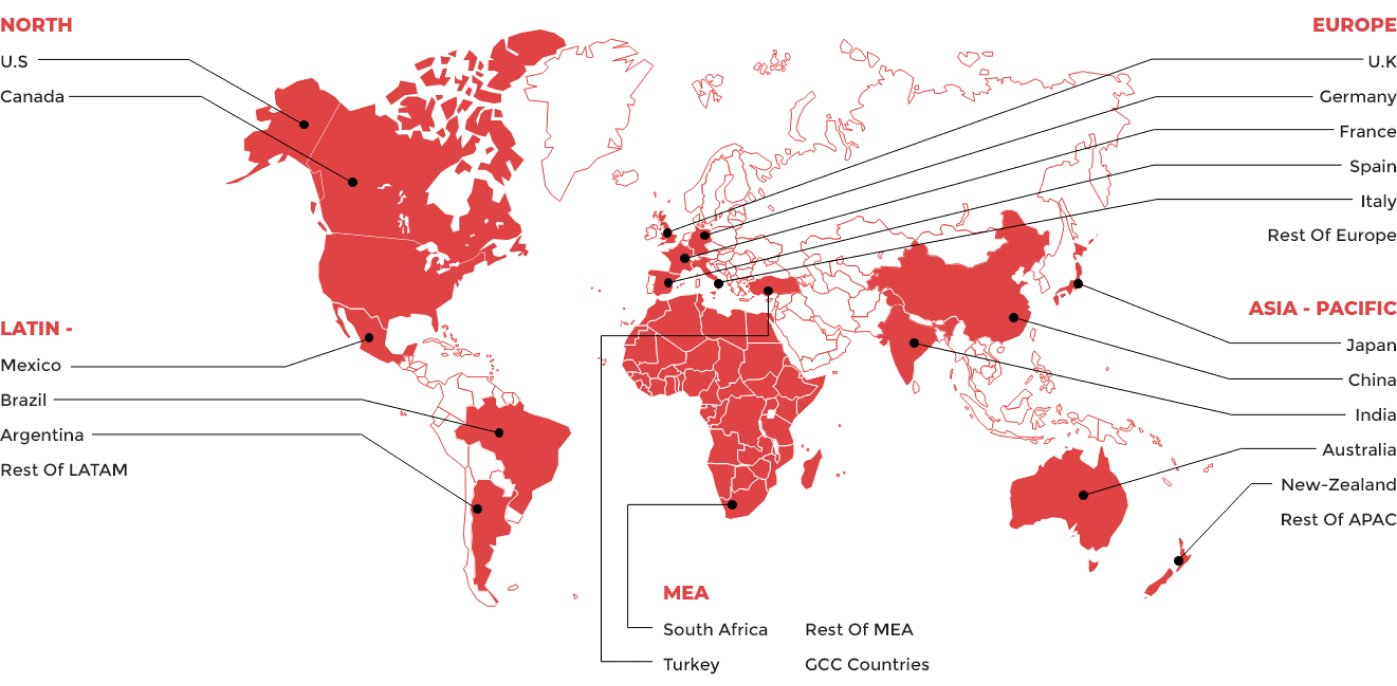

The performance coatings market has been classified into North America, Asia Pacific, Europe, Latin America, Middle East and Africa, and the rest of MEA.

Content Updated Date: Apr 2025

| 1. Executive Summary |

| 2. Global Performance Coatings Market Introduction |

| 2.1.Global Performance Coatings Market - Taxonomy |

| 2.2.Global Performance Coatings Market - Definitions |

| 2.2.1.Type |

| 2.2.2.Coating Technology |

| 2.2.3.End User |

| 2.2.4.Geography |

| 2.2.5.Region |

| 3. Global Performance Coatings Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID 19 on Market |

| 4. Global Performance Coatings Market Analysis, 2020-2024 and Forecast 2025-2031 |

| 4.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Performance Coatings Market By Type, 2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 5.1. Epoxy |

| 5.1.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Silicon |

| 5.2.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Polyester |

| 5.3.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Acrylic |

| 5.4.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 5.5. Alkyd |

| 5.5.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.5.3. Market Opportunity Analysis |

| 5.6. Polyurethane |

| 5.6.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.6.3. Market Opportunity Analysis |

| 5.7. Fluoropolymer |

| 5.7.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.7.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.7.3. Market Opportunity Analysis |

| 5.8. Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 5.8.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 5.8.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.8.3. Market Opportunity Analysis |

| 6. Global Performance Coatings Market By Coating Technology, 2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 6.1. Solvent-based |

| 6.1.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Water-based |

| 6.2.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Powder-based |

| 6.3.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 7. Global Performance Coatings Market By End User, 2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 7.1. Building and Construction |

| 7.1.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Automotive and Transportation |

| 7.2.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Industrial |

| 7.3.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 7.4. Aerospace & Defense |

| 7.4.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.4.3. Market Opportunity Analysis |

| 7.5. Marine |

| 7.5.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.5.3. Market Opportunity Analysis |

| 7.6. Other End-user Industries |

| 7.6.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 7.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.6.3. Market Opportunity Analysis |

| 8. Global Performance Coatings Market By Geography, 2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 8.1. North America |

| 8.1.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 8.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.1.3. Market Opportunity Analysis |

| 8.2. Europe |

| 8.2.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 8.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.2.3. Market Opportunity Analysis |

| 8.3. The Asia Pacific |

| 8.3.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 8.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.3.3. Market Opportunity Analysis |

| 8.4. Latin America |

| 8.4.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 8.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.4.3. Market Opportunity Analysis |

| 8.5. MEA |

| 8.5.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 8.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.5.3. Market Opportunity Analysis |

| 9. Global Performance Coatings Market By Region, 2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 9.1. North America |

| 9.1.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 9.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.1.3. Market Opportunity Analysis |

| 9.2. Europe |

| 9.2.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 9.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.2.3. Market Opportunity Analysis |

| 9.3. Asia Pacific (APAC) |

| 9.3.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 9.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.3.3. Market Opportunity Analysis |

| 9.4. Middle East and Africa (MEA) |

| 9.4.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 9.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.4.3. Market Opportunity Analysis |

| 9.5. Latin America |

| 9.5.1. Market Analysis, 2020-2024 and Forecast, 2025-2031, (Sales Value USD Million) |

| 9.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.5.3. Market Opportunity Analysis |

| 10. North America Performance Coatings Market ,2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 10.1. Type Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Epoxy |

| 10.1.2.Silicon |

| 10.1.3.Polyester |

| 10.1.4.Acrylic |

| 10.1.5.Alkyd |

| 10.1.6.Polyurethane |

| 10.1.7.Fluoropolymer |

| 10.1.8.Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 10.2. Coating Technology Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Solvent-based |

| 10.2.2.Water-based |

| 10.2.3.Powder-based |

| 10.3. End User Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.Building and Construction |

| 10.3.2.Automotive and Transportation |

| 10.3.3.Industrial |

| 10.3.4.Aerospace & Defense |

| 10.3.5.Marine |

| 10.3.6.Other End-user Industries |

| 10.4. Geography Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.4.1.North America |

| 10.4.2.Europe |

| 10.4.3.The Asia Pacific |

| 10.4.4.Latin America |

| 10.4.5.MEA |

| 10.5. Country Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.5.1.United States of America (USA) |

| 10.5.2.Canada |

| 11. Europe Performance Coatings Market ,2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 11.1. Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Epoxy |

| 11.1.2.Silicon |

| 11.1.3.Polyester |

| 11.1.4.Acrylic |

| 11.1.5.Alkyd |

| 11.1.6.Polyurethane |

| 11.1.7.Fluoropolymer |

| 11.1.8.Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 11.2. Coating Technology Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Solvent-based |

| 11.2.2.Water-based |

| 11.2.3.Powder-based |

| 11.3. End User Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.Building and Construction |

| 11.3.2.Automotive and Transportation |

| 11.3.3.Industrial |

| 11.3.4.Aerospace & Defense |

| 11.3.5.Marine |

| 11.3.6.Other End-user Industries |

| 11.4. Geography Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.4.1.North America |

| 11.4.2.Europe |

| 11.4.3.The Asia Pacific |

| 11.4.4.Latin America |

| 11.4.5.MEA |

| 11.5. Country Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.5.1.Germany |

| 11.5.2.France |

| 11.5.3.Italy |

| 11.5.4.United Kingdom (UK) |

| 11.5.5.Spain |

| 11.5.6.Rest of EU |

| 12. Asia Pacific (APAC) Performance Coatings Market ,2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 12.1. Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Epoxy |

| 12.1.2.Silicon |

| 12.1.3.Polyester |

| 12.1.4.Acrylic |

| 12.1.5.Alkyd |

| 12.1.6.Polyurethane |

| 12.1.7.Fluoropolymer |

| 12.1.8.Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 12.2. Coating Technology Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Solvent-based |

| 12.2.2.Water-based |

| 12.2.3.Powder-based |

| 12.3. End User Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Building and Construction |

| 12.3.2.Automotive and Transportation |

| 12.3.3.Industrial |

| 12.3.4.Aerospace & Defense |

| 12.3.5.Marine |

| 12.3.6.Other End-user Industries |

| 12.4. Geography Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.4.1.North America |

| 12.4.2.Europe |

| 12.4.3.The Asia Pacific |

| 12.4.4.Latin America |

| 12.4.5.MEA |

| 12.5. Country Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.5.1.China |

| 12.5.2.India |

| 12.5.3.Australia and New Zealand (ANZ) |

| 12.5.4.Japan |

| 12.5.5.Rest of APAC |

| 13. Middle East and Africa (MEA) Performance Coatings Market ,2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 13.1. Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.1.1.Epoxy |

| 13.1.2.Silicon |

| 13.1.3.Polyester |

| 13.1.4.Acrylic |

| 13.1.5.Alkyd |

| 13.1.6.Polyurethane |

| 13.1.7.Fluoropolymer |

| 13.1.8.Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 13.2. Coating Technology Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.2.1.Solvent-based |

| 13.2.2.Water-based |

| 13.2.3.Powder-based |

| 13.3. End User Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.3.1.Building and Construction |

| 13.3.2.Automotive and Transportation |

| 13.3.3.Industrial |

| 13.3.4.Aerospace & Defense |

| 13.3.5.Marine |

| 13.3.6.Other End-user Industries |

| 13.4. Geography Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.4.1.North America |

| 13.4.2.Europe |

| 13.4.3.The Asia Pacific |

| 13.4.4.Latin America |

| 13.4.5.MEA |

| 13.5. Country Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.5.1.GCC Countries |

| 13.5.2.South Africa |

| 13.5.3.Rest of MEA |

| 14. Latin America Performance Coatings Market ,2020-2024 and Forecast 2025-2031 (Sales Value USD Million) |

| 14.1. Type Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.1.1.Epoxy |

| 14.1.2.Silicon |

| 14.1.3.Polyester |

| 14.1.4.Acrylic |

| 14.1.5.Alkyd |

| 14.1.6.Polyurethane |

| 14.1.7.Fluoropolymer |

| 14.1.8.Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) |

| 14.2. Coating Technology Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.2.1.Solvent-based |

| 14.2.2.Water-based |

| 14.2.3.Powder-based |

| 14.3. End User Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.3.1.Building and Construction |

| 14.3.2.Automotive and Transportation |

| 14.3.3.Industrial |

| 14.3.4.Aerospace & Defense |

| 14.3.5.Marine |

| 14.3.6.Other End-user Industries |

| 14.4. Geography Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.4.1.North America |

| 14.4.2.Europe |

| 14.4.3.The Asia Pacific |

| 14.4.4.Latin America |

| 14.4.5.MEA |

| 14.5. Country Analysis 2020-2024 and Forecast 2025-2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.5.1.Brazil |

| 14.5.2.Mexico |

| 14.5.3.Rest of LA |

| 15. Competition Landscape |

| 15.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 15.2.1.Akzo Nobel NV (Netherlands) |

| 15.2.2.PPG Industries Inc. (US) |

| 15.2.3.Kansai Nerolac Paints Limited (India) |

| 15.2.4.Metal Coatings Corp. (US) |

| 15.2.5.Toefco Engineered Coating Systems Inc. (US) |

| 15.2.6.Endura Coatings LLC (US) |

| 15.2.7.Beckers Group (Germany) |

| 15.2.8.Nippon Paint Holdings Co. Ltd (Japan) |

| 15.2.9.The Sherwin-Williams Company (US) |

| 15.2.10.AFT Fluorotec Ltd (UK) |

| 15.2.11.The Chemours Company (US) |

| 15.2.12.Hempel Group (Denmark) |

| 16. Research Methodology |

| 17. Appendix and Abbreviations |

Key Market Players